KAJANG (Jan 11): A Universiti Tunku Abdul Rahman (UTAR) team that recently conducted an analysis of the Malaysian housing market has concluded that it is best to buy properties now as it expected the current dampened market sentiment to recover in the first quarter of 2018.

The research was conducted under the Higher Education Ministry’s Fundamental Research Grant Scheme.

The first part of the research findings was released by UTAR a week ago, while part two was released today.

Part one suggested that the current property market downturn plaguing the country will not be as turbulent as the ones that occurred some two decades ago as this downturn is taking a gentler gradient.

In part two of the research, it was concluded that the current market scenario seems to signal “buy”.

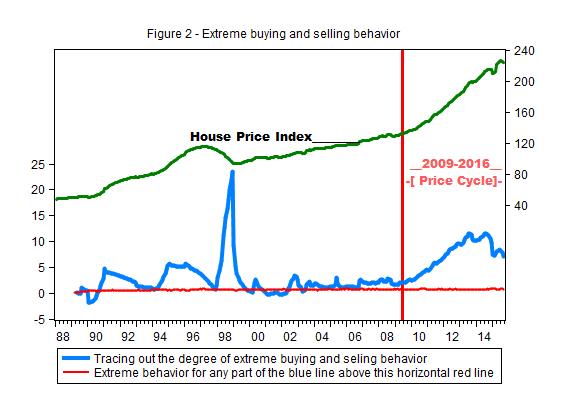

“Looking at the graph, the housing market has already entered the downward slope of the current cycle and thus far, it looks relatively stable, reflecting the supporting efforts of the government and housing suppliers. Logically, this is now the period to consider buying,” the research team suggested.

According to the chart, the current cycle started in 2009 and peaked in 2013. Prices began moving down since 2014.

The research team noted that the Malaysian property market is still on a “gradual down slide”. The phenomenon is also a vital signal to enter the housing market, it said.

“You may ask, why not wait for the cycle to bottom out before we start buying. That would be ideal but there is no specific method to forecast and pin-point the bottom,” the team explained.

Furthermore, it said now is the “good time to buy homes” because developers are offering rebates and incentives.

“It is basic indication that the housing market has excessive inventories. However, constrained by rising costs, there is a limit to lowering prices. During an economic downturn, weak and smaller developers would likely be forced out of the market and thus ease market competition,” it said.

Moreover, the team believes that when the backlog is cleared, prices of new homes may be more expensive as a supply squeeze may cause prices to go up.

On the other hand, the team suggested that the good times for the real estate sector will return when the economy climbs back in full steam, because by then, the housing market would have entered the next cycle.

“The bottom line is still market sentiment and purchasing power of consumers. Both are closely linked with disposable income, and that in turn depends largely on the economy,” it explained.

Some positive news have emerged recently such as oil prices picking up and China’s significant increase in investments in Malaysia.

“As the impact of these development projects on the economy starts to kick in, and barring changes in the local political scene, we expect market confidence and sentiment to start improving by the first quarter of 2018.”

TOP PICKS BY EDGEPROP

Desa ParkCity (Adora)

Desa ParkCity, Kuala Lumpur

Country Heights Kajang

Country Heights, Selangor