THE market is rife with speculations on whether private residential prices are bottoming out, and there are positive signs that are fanning hopes. Developers sold 7,551 condominiums and apartments in 2016, more than 2015’s figure of 6,895 units, based on caveats lodged up to early December 2016. Including landed homes and executive condominiums (ECs), primary sales were up 15% y-o-y from 9,957 to 11,430.

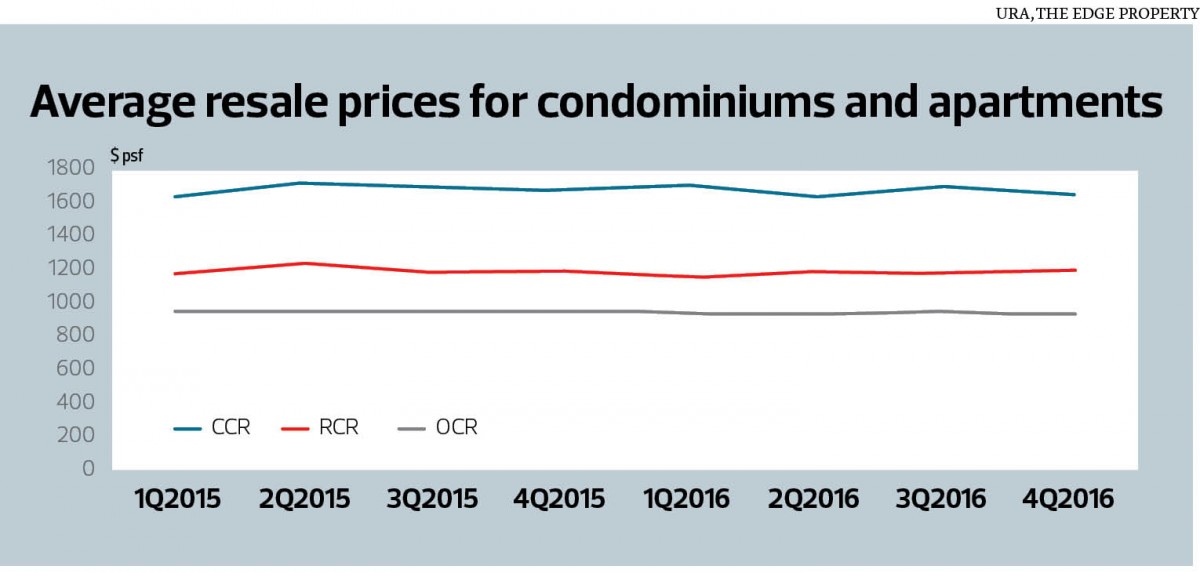

Resale volume has also picked up, led by Core Central Region, also known as the high-end market. The number of resale caveats lodged on condominiums and apartments in the CCR rose 17% y-o-y from 1,094 to 1,285, excluding units sold by developers in major delicensed projects such as Ardmore Three, d’Leedon and OUE Twin Peaks, which are also classified as resale transactions by the URA.

Resale transactions edged up 9% in Rest of Central Region and 6% in Outside Central Region. As a result, resale prices of condominiums and apartments have also held firm (see chart).

Notwithstanding this, sluggish employment and economic data means the market is likely to be heading for an L-shaped recovery. A total of 13,730 workers were laid off in the first nine months of 2016, the highest figure since 2009, according to the Ministry of Manpower. At the same time, total employment contracted in 3Q2016, the first decline since 1Q2015, following slower growths in the preceding two quarters.

Meanwhile, economists polled by the Monetary Authority of Singapore have trimmed their 2017 economic growth forecast, producing a median of 1.5% in the December survey, down from 2.1% and 1.8% in the June and September surveys respectively.

On a slightly brighter note, the unemployment rate has stayed flattish for Singaporeans and residents. And the International Monetary Fund projected a slight improvement in the global economy in 2017, which is good news for Singapore’s open economy.

However, what could tip the balance is the rising vacancy rates, which touched 10.4% in 2Q2016 and 10% in 3Q2016, the highest rate since 3Q2005. According to the latest statistics released by the URA, rental decline for private, non-landed homes accelerated to 4% y-o-y in 3Q, after a 3% decline in 2Q. The mass market was the worst performer as rents declined 6% y-o-y in 3Q.

Return to fundamentals

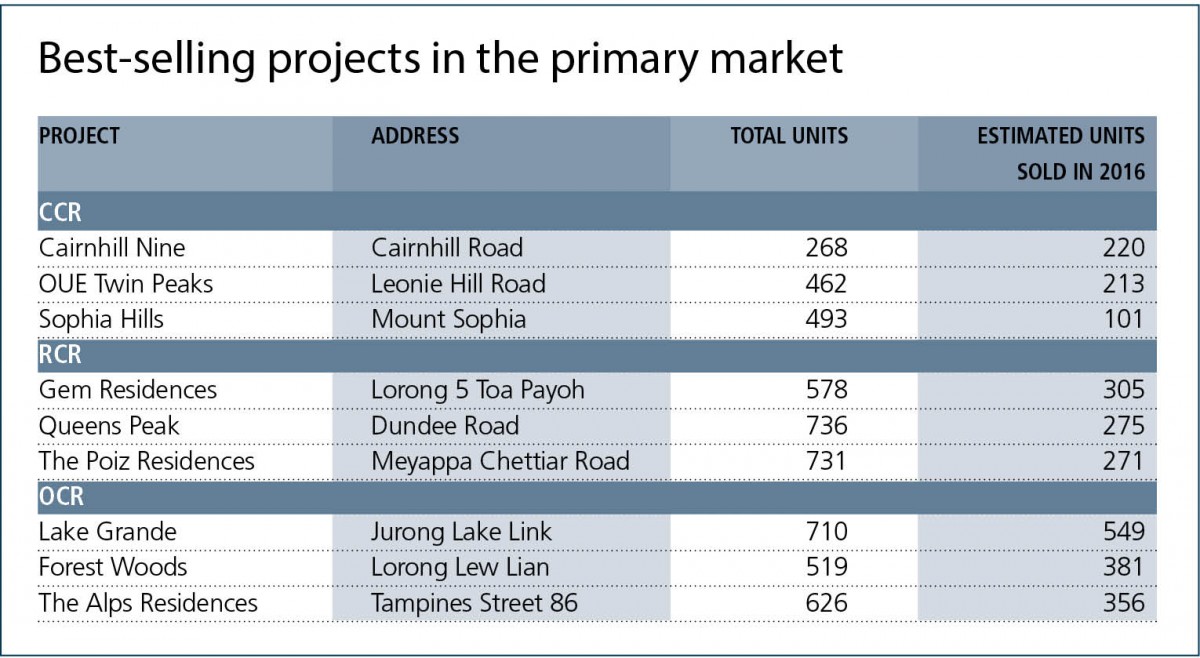

The improvement in primary sales was driven by several projects with attractive locations and price points. MCL Land’s Lake Grande was the best-selling project with 549 units sold to date at a median price of S$1,359 (RM4,199) psf. The 710-unit development is located near Lakeside MRT station, a stone’s throw from Jurong Lake.

Forest Woods took the second spot with 381 units sold at a median price of S$1,410 psf. Located on Lorong Lew Lian, the project is within walking distance of Serangoon MRT station and nex shopping mall.

Trailing closely is The Alps Residences on Tampines Street 86 with 356 units sold at a median price of S$1,072 psf.

In the city fringe, Gem Residences and Queens Peak topped the sales chart. A total of 305 units were sold at Gem Residences at a median price of S$1,434 psf. The project is located on Lorong 5 Toa Payoh. Meanwhile, Hao Yuan Investment has moved 275 units at Queens Peak at a median price of S$1,629 psf since the project was launched in November 2016. Queens Peak is located next to Queenstown MRT station.

In the high-end segment, the encouraging sales at several projects point to price elasticity of demand. CapitaLand sold 220 units at Cairnhill Nine, a mixed-use development that will include serviced residence Ascott Orchard Singapore. About 57% of the units sold were below S$2 million.

At delicensed projects, Wheelock Properties sold an estimated 46 units in 2016 at Ardmore Three, a luxury condominium comprising 84 freehold units. The developer had offered buyers a 15% discount and a 15% additional buyer’s stamp duty rebate under the “ABSD assistance package” to offset the cost.

Other incentive schemes have also paid off for developers. OUE has offloaded an estimated 210 units at OUE Twin Peaks since it started offering a deferred payment scheme in April 2016. CapitaLand has also found buyers for some 85 units at d’Leedon since it rolled out the stay-then-pay programme for the project in June the same year.

The unsold stock controversy

As a result of higher sales in the primary market, the stock of unsold units for private, non-landed homes has eased off from 22,583 as at end-2015 to 21,142 as at end-3Q2016. However, there are approximately 2,500 to 3,000 of additional unsold units from delicensed projects, mostly in the CCR.

The mass market is said to have the lowest ratio of unsold units to take-up rate compared with the high-end and city-fringe segments. As at end-3Q2016, there were around 8,500 unsold units in the mass market, just 1.9 times the take-up rate of 4,500 units in 2016. On the other hand, there were 5,100 unsold units in the high-end segment, which was 7.7 times the take-up rate of 660 units in the segment in 2016. This led to a perception that the mass market could be undersupplied.

There are, however, other issues that must be considered. For example, there is limited supply of land in the high-end segment over a longer time horizon, in particular prime districts 9 and 10. On the other hand, there is virtually no limit to the number of housing units that can be generated in suburban areas through intensification of land use. In addition, mass-market projects also face competition from ECs and public housings. And finally, the products in the luxury segments are more differentiated, which enhances their scarcity value. On these notes, the core prime districts 9 and 10 at least score higher on market fundamentals in the long run.

Notable future launches

Based on tender award dates for sites sold under the Government Land Sales Programme, developers could potentially launch nine private, non-landed residential projects in 2017.

One of the highly anticipated projects is the sea-fronting condominium on Siglap Road by Frasers Centrepoint. The 840-unit development will be a stone’s throw from the future Siglap MRT station on the Thomson-East Coast Line, which is slated for completion in 2023.

Another high-profile development would be Paya Lebar Quarter, an integrated development next to Paya Lebar MRT station by Lendlease and Abu Dhabi Investment Authority. The project will comprise the 429-unit Park Place Residences, 900,000 sq ft of Grade A offices and a shopping mall with over 340,000 sq ft of retail space.

GuocoLand could also launch its residential development at Martin Place, which it clinched in July 2016. The project, which can yield up to 450 units, will be a short walk from the upcoming Great World MRT station on the Thomson-East Coast Line.

Other potential launches with strong location attributes are Tang City Holdings’ mixed-use development on Alexandra View, which is next to Redhill MRT station, and Chip Eng Seng’s Grandeur Park Residences near Tanah Merah MRT station.

In addition, the government will launch five residential sites under the confirmed list for the Government Land Sales Programme 1H2017. These sites can yield around 2,330 housing units, more than the 2,170 units offered under the 2H2016 confirmed list and 1,560 units for 1H2016.

One of the sites, which can yield 735 units, is next to Woodleigh MRT station. Another site on Tampines Avenue 10 is flanked by The Santorini and The Alps Residences.

Feily Sofian is head of research at The Edge Property Singapore.

This article first appeared in The Edge Property Singapore, a pullout of The Edge Singapore, on Dec 26, 2016.

TOP PICKS BY EDGEPROP

Medini Signature

Iskandar Puteri (Nusajaya), Johor