WCT Holdings Bhd (Dec 8, RM1.77)

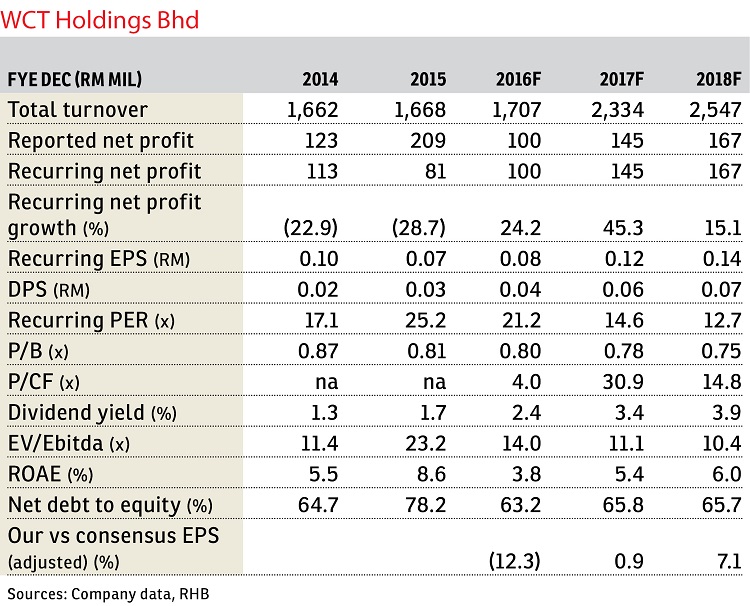

Downgrade to neutral call with a target price of RM1.81: We revisit WCT Holdings Bhd after the recent change in major shareholding, as its co-founders disposed their stake to a company linked to Tan Sri Desmond Lim of Pavilion Group. While we see continuing efforts to monetise its assets and a possible split in its business units, the sluggish property market suggests only reasonable valuations near its book value.

Last month, WCT’s long-serving managing director Peter Taing Kim Hwa and co-founder Wong Sewe Wing, through their vehicle WCT Capital Sdn Bhd, divested their 245.72 million WCT shares or 19.67% stake to Dominion Nexus Sdn Bhd, a company linked to Lim. The shares were crossed at RM2.50 each.

Our assessment shows the deal could possibly mark a significant reshuffle in WCT’s business directive. While the listing of Paradigm Mall and Aeon Bukit Tinggi Shopping Centre via a new real estate investment trust (REIT) looks unlikely, we see the possibility of both assets being injected into Pavilion REIT.

Separately, we think there is the potential of a merger of its property unit into Malton Bhd, a property developer in which Lim owns 41.2%. If this scenario materialises, WCT would eventually focus primarily only on construction.

WCT’s construction outstanding order book, inclusive of the mass rapid transit line 2 viaduct package V204 won recently, stands at RM4.8 billion as at Sept 30, which should keep the unit busy for the next three years. We see more infrastructure projects in the pipeline scheduled to be awarded in the coming months through the first half of 2017.

All eyes are on the light rail transit line 3 and the Pan Borneo highway (in Sabah). Furthermore, there is also room for more development in Malaysia, hence more construction projects beyond 2018 for a veteran contractor like WCT to ride on.

We are excited over the possibility of efforts to split the group’s business operations and monetise its assets following the recent change in major shareholder. That said, the overall sluggish property market suggests only reasonable price tags for its mall assets and property business, hence there are unlikely to be any major gains there. — RHB Research, Dec 7

This article first appeared in The Edge Financial Daily, on Dec 9, 2016. Subscribe to The Edge Financial Daily here.

TOP PICKS BY EDGEPROP

Bandar Baru Sri Petaling

Bandar Baru Sri Petaling, Kuala Lumpur

Beranang Industrial Park

Semenyih, Selangor

Kuchai Entrepreneurs Park

Kuchai Lama, Kuala Lumpur

Happy Garden (Taman Gembira)

Jalan Klang Lama (Old Klang Road), Kuala Lumpur

Olive Hill Business Park

Seri Kembangan, Selangor

Cahaya Alam (Shah Alam Utama)

Shah Alam, Selangor